Are Saudi Arabia’s new tourism offerings too pricey? That’s the sentiment on the ground at the Future Hospitality Summit (FHS) in Riyadh this week.

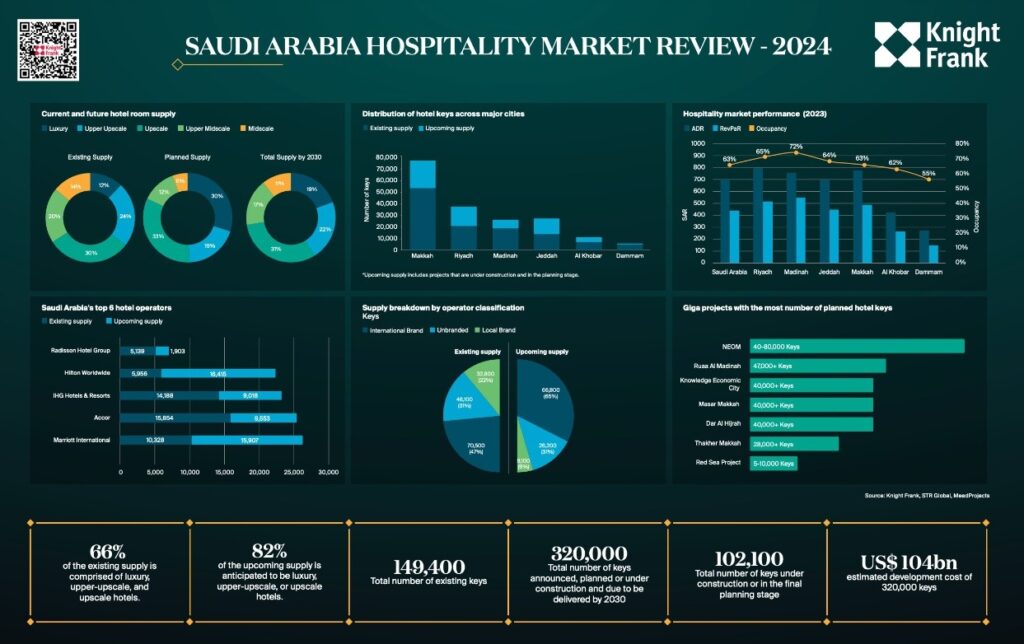

Between now and the end of the decade, 320,000 new hotel rooms are expected to open in Saudi Arabia. According to Knight Frank, 82% of those new rooms are in the luxury and upscale segments. And 66% of Saudi’s current 149,400 rooms are also upscale and luxury.

Saudi eventually wants 70 million international tourists to come visit. But it was only in 2019 that it opened for tourism at all. Saudi had 27 million international visitors in 2023 – many of them came for religious travel rather than stays at newly-developed leisure hubs.

‘Ego Projects Are Going Away’

Radisson’s regional vice president of development, Elie Milky said on a panel at the summit that “ego projects” by private investors are becoming less prevalent.

“Emotional and ego investments are going away. We need to be in line with the tourism strategy but we need to help it in not only promoting five-star categories,” Milky said. “It’s too risky for some investors to go into a place with a five-star hotel. It might be a nice idea for a five-star hotel, but you might not see return on investment.”

Many developments are being funded by Saudi’s Public Investment Fund (PIF). Chaired by the crown prince Mohammed bin Salman, PIF owns and develops tourism sites such as Neom, Diriyah Gate and The Red Sea – three leisure destinations with a swell of luxury facilities.

“Giga-projects” are being built solely with five-star hotels. Some of them are planning to cap visitation as well, making it even tougher to accommodate 70 million visitors.

The Red Sea is one such example: The Maldives-like project along the Saudi coastline is planning to open 50 luxury hotels. The plan is to open 16 hotels by 2025, and another 34 before 2030.

To date, every hotel announced there has been a luxury name.

Despite costing billions, The Red Sea is going to chip in one-seventieth towards achieving international tourism goals. The site will limit visits upon completion to protect the environment.

‘Mid-Markets Democratize Travel’

With luxury projects not moving the needle much in achieving visitor goals, hotel developers are hammering for more economical brands.

At another session at the summit this week, Wyndham’s regional MD, Panos Loupasis said: “Saudi will become exclusive. That’s a problem. If you want to attract people, and have them come again and again, visit more cities, it can’t be so exclusive. Three-star hotels are enablers for travelers. They democratize travel.”

“The market is not well-educated in mid-scale brands. There seems to be a strong focus on luxury in Saudi,” added Leva Hotels CEO JS Anand, a Dubai-based operator serving mid-scale.

“Not everybody will pay $2,000 a night,” he added.

The CEO of a privately-held hotel developer and owner had similar thoughts. “Mid-market hotels are the core accommodation in any city. A lot of people in the segment are just looking for glitz and glamor rather than a real investment strategy,” said Tashyid Urban Development CEO Falih Motasim Hajaj.

Following the publication of this article, a spokesperson from Saudi Tourism Authority sent a statement to Skift acknowledging the importance of luxury accommodation but also the range of mid-market choices in the country.

“Luxury hotels and products are a key part of what we are developing in Saudi, and we know that for some of our target audiences, both domestically and internationally, having luxury destination hotels is essential to their experience,” the spokesperson said. “However, our strategy and ambition are much bigger than that, as set out in our national tourism strategy. It is not just about luxury, it’s about building a year-round offering that caters for visitors across all tiers.”

Luxury First, Mid-market Second

Accor is one of the biggest players in growing Saudi’s tourism and hospitality infrastructure. The French operator wants an additional 45 properties with more than 9,800 rooms by 2030 in Saudi.

In the major locations like the giga-projects, these will be luxury hotels, according to Accor’s Group Deputy CEO and Premium, Midscale & Economy Division CEO, Jean-Jacques Morin.

“Luxury is in the big leisure projects – Neom, Red Sea, Diriyah and so on,” he said. “We are by far the largest operator in the holy cities as well… While in second-tier cities we have a strategy for premium, midscale and economy.”

Are There Any Mid-market Hotels Opening Up in Giga-projects?

There are a few mid-market hotels, but they mostly act as lodging for incoming consultants, contractors and architects. The Red Sea has Turtle Bay hotel to put up staff in, while Trojena – one part of the Neom project – has a Hampton by Hilton up and running.

Even this hotel is commanding high rates as the only hotel for business people to use in the area.

“In terms of today, converting mid-scale hotels will drive super-normal profits,” said Hilton’s Managing Director, Development, Middle East & North Africa, Amir Lababedi. “As much as we can, we will convert existing buildings. Trojena has no hotels that any contractor can use. That’s why we brought the Hampton.”

He added that Hilton is looking at many of Saudi’s existing budget hotels as options for its new Spark brand.

Elsewhere in Neom, Oxagon has a Yotel on the way, again designed mostly for professionals.

How Many Annual Visits Saudi Projects Expect by 2030:

- The Red Sea: 1 million

- Amaala: 500,000

- Trojena (a part of Neom): 700,000

- Sindalah (a part of Neom): 876,000

- Neom altogether: 5 million

- Diriyah: 50 million (including domestic day trips)

Subscribe to Skift Pro to get unlimited access to stories like these

{{monthly_count}} of {{monthly_limit}} Free Stories Read

Subscribe NowAlready a member? Sign in here

Subscribe to Skift Pro to get unlimited access to stories like these

Your story count resets on {{monthly_reset}}

Already a member? Sign in here

Subscribe to Skift Pro to get unlimited access to stories like these

Already a member? Sign in here