Skift Take

Mobile is everything in Latin America, even more so than the U.S., so travelers in Brazil and Mexico are more receptive to using digital payment features than their peers in the U.S.

Credit cards and cash aren’t disappearing anytime soon but Latin American business travelers in Brazil and Mexico appear keener to bid them farewell for digital payments than their counterparts in other regions, including the U.S.

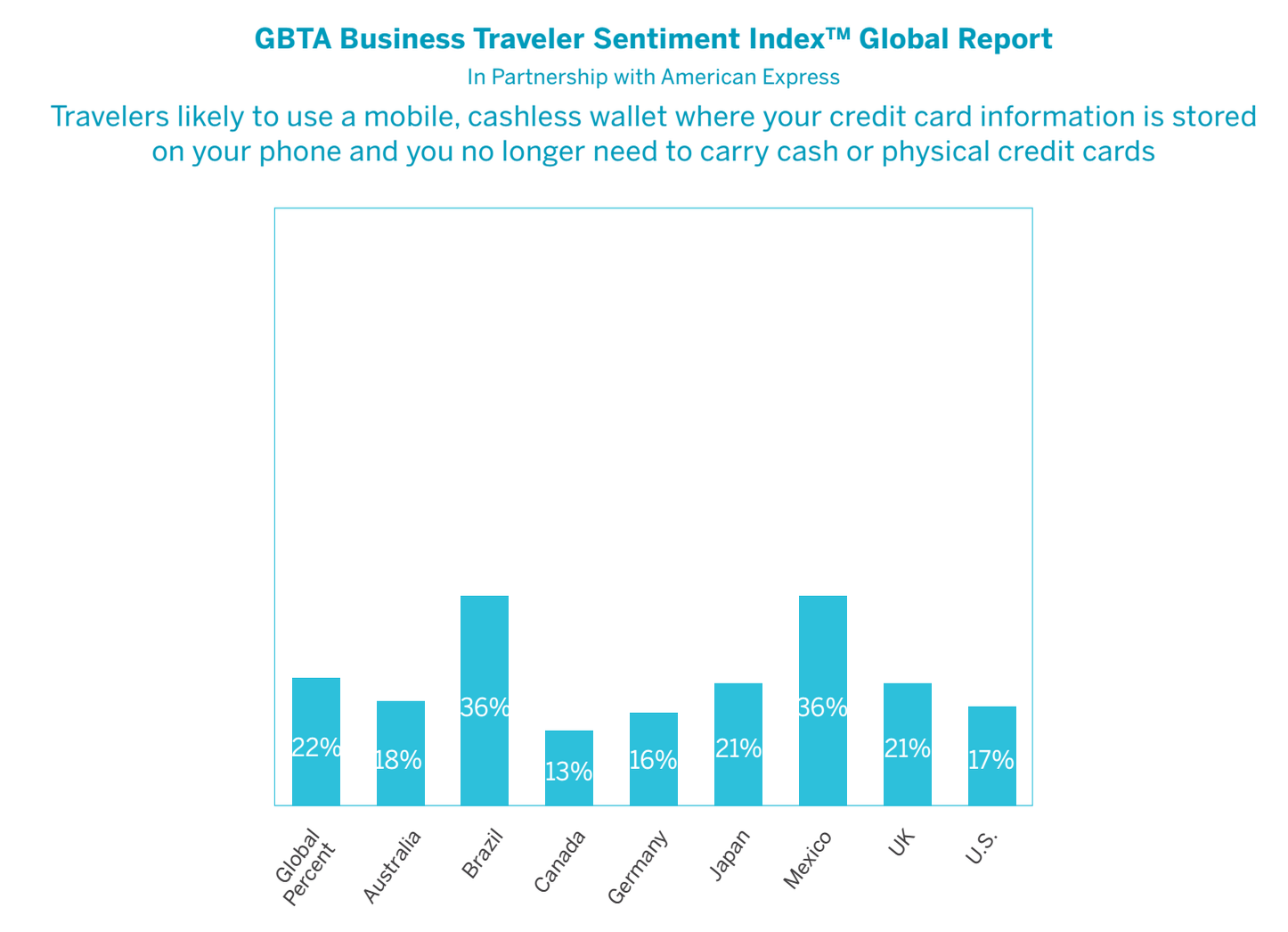

In a Global Business Travel Association and American Express survey, 36% of both Brazilian and Mexican business traveler respondents indicated they’re likely to use mobile, cashless wallets where credit card information is stored on a smartphone. More than 3,800 business travelers from Australia, Brazil, Canada, Germany, Japan, Mexico, the U.K. and the U.S. who took four or more business trips between March 2014 and April 2015, participated in the survey.

Some 17% of U.S. business traveler respondents said they’d use mobile wallets, less than half the percentage of Brazilian and Mexican respondents but still encouraging. The global average is 22% for respondents who said they’d use them. Given mobile wallets are still a novelty, with Apple Pay’s release only last October and Google Wallet in 2011, the percentage of business travelers willing to adopt these payment methods early on is promising.

Mobile wallets eliminate the need to carry cash or physical credit cards to make payments and the rollout of mobile payment technologies have spearheaded the conversation on the future of transactions. Several brands, including Marriott International, have been quick to make these payment options available to travelers.

Source: GBTA and American Express

“Although we did not specifically ask why business travelers are interested in the cashless wallet, I think it may be due, in part, to the fact that payment options are much more limited in Mexico and Brazil than in the U.S., although business travelers are just as likely to have smartphones in all of the countries,” said Joseph Bates, a spokesperson for the association.

“Therefore, the business travelers in Mexico and Brazil are much more interested in the cashless wallet as it solves for a challenge they experience more than U.S. business travelers do.”

The Reason for U.S. Business Travelers’ Low Interest in New Tech

Business travelers in managed travel programs may find that their travel providers aren’t keeping pace with technological changes such as the advent of digital wallets. One third of 237 U.S. travel managers the association surveyed in a separate report earlier this year said they find it challenging to keep up with new technology.

Only 39% of these travel managers believe business and technology are aligned within their organization, leaving business travelers who value new tech at the mercies of their companies’ or agencies’ willingness to move forward.

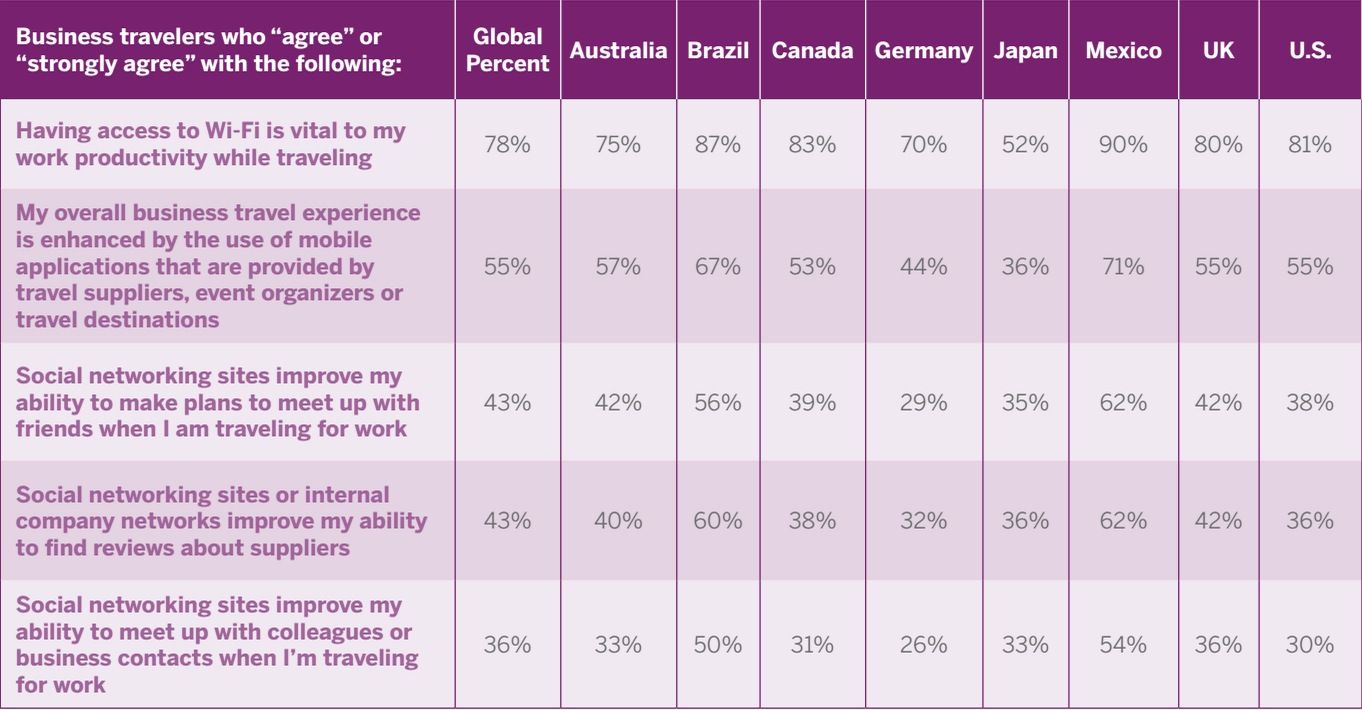

In the survey of business travelers, 50% and 54% of Brazilian and Mexican respondents, respectively, indicated social media improves their abilities to meet with colleagues or business contacts when traveling for work, compared to 30% of U.S. respondents.

In-flight Wi-Fi was also more highly valued with this group as 87% of Brazilian respondents and 90% of Mexican respondents said Wi-Fi is vital for work productivity while traveling, versus 81% of American respondents who share this sentiment.

Source: GBTA and American Express

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: apple pay, gbta, google wallet

Photo credit: A business traveler on her smartphone at New York's LaGuardia Airport. Matthew Hurst / Flickr